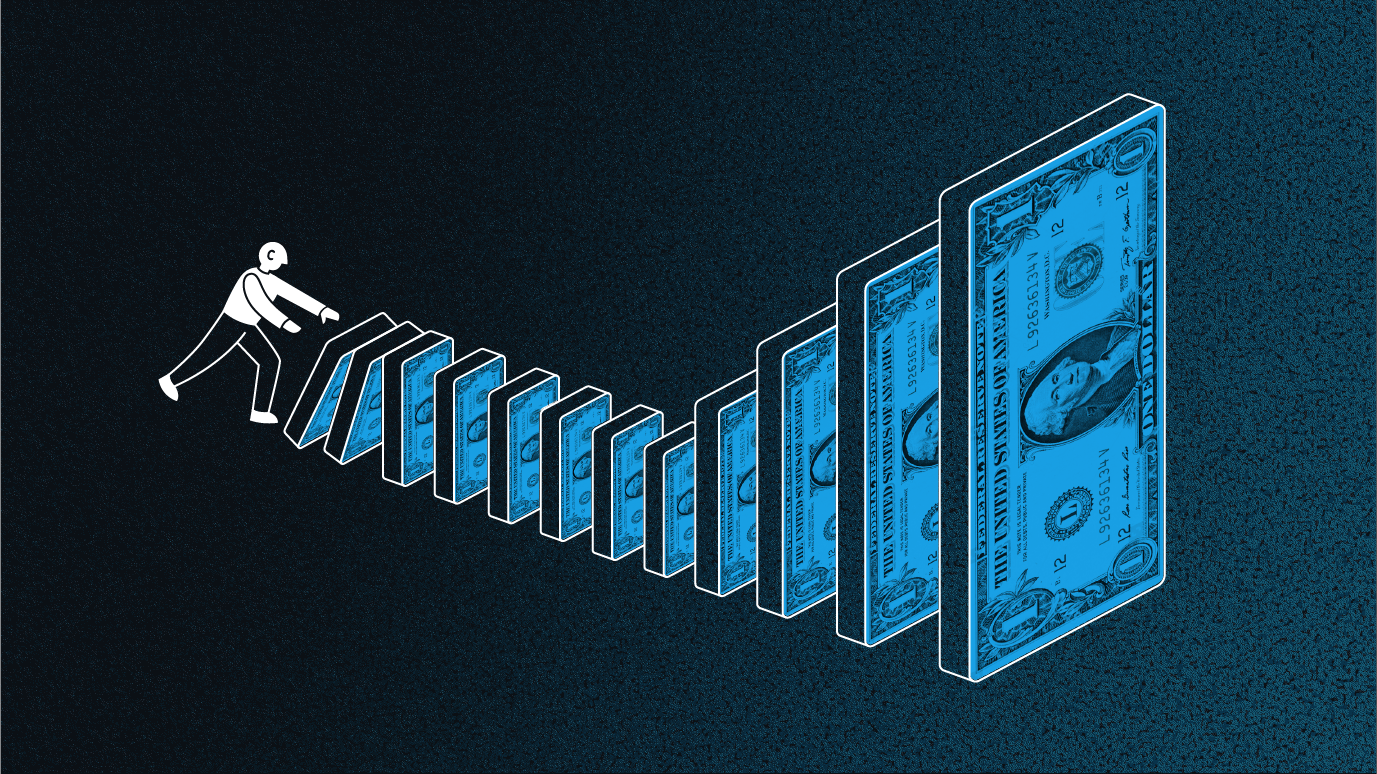

When it comes to maximizing your savings, one of the most important concepts to understand is compound interest. Compound interest is a powerful force that can help your savings grow significantly over time, especially when it comes to long-term investing and retirement planning. In this article, we’ll explore the basics of compound interest and how you can use it to maximize your savings.

What is Compound Interest?

Compound interest is interest that is calculated on both the principal amount and any accumulated interest. In other words, it’s interest on interest. When you invest your money in a savings account or an investment account, the interest you earn each year is added to your balance, and the interest for the following year is calculated based on the new balance. This cycle continues, with the interest earned each year adding to the balance and increasing the amount of interest earned in subsequent years.

For example, let’s say you invest $1,000 in a savings account that pays 5% interest annually. At the end of the first year, you’ll earn $50 in interest, bringing your balance to $1,050. In the second year, you’ll earn 5% interest on $1,050, which is $52.50. This brings your balance to $1,102.50. Over time, the amount of interest earned each year will increase as your balance grows.

Compound Interest and Savings Accounts:

Savings accounts are a great way to take advantage of compound interest. Most savings accounts are designed to accumulate interest over time, and many offer competitive interest rates that can help your savings grow faster.

One of the keys to maximizing your savings with compound interest is to find a savings account with a high interest rate. The higher the interest rate, the faster your savings will grow. You can compare savings account interest rates online to find the best option for your needs.

Another important factor to consider is how often the interest is compounded. Most savings accounts compound interest daily, monthly, or quarterly. The more frequently the interest is compounded, the faster your savings will grow. For example, if two savings accounts have the same interest rate, but one compounds interest daily and the other compounds interest quarterly, the account that compounds interest daily will earn more interest over time.

Compound Interest and Investment Accounts:

Investment accounts are another great way to take advantage of compound interest. Many investment accounts, such as mutual funds and exchange-traded funds (ETFs), are designed to grow over the long-term, and compound interest plays a big role in this growth.

One of the advantages of investment accounts is that they often offer higher interest rates than savings accounts. However, it’s important to remember that investment accounts come with more risk. While savings accounts are FDIC-insured and offer a guaranteed rate of return, investment accounts are subject to market fluctuations and may lose value.

When it comes to investment accounts, it’s important to choose the right mix of investments for your needs. This may include a combination of stocks, bonds, and other assets. The right mix will depend on your risk tolerance, time horizon, and investment goals.

Long-Term Investing and Retirement Planning:

Compound interest is particularly powerful when it comes to long-term investing and retirement planning. By starting early and investing consistently over time, you can take advantage of the power of compound interest to build a significant nest egg for retirement.

For example, let’s say you start investing $500 per month in an investment account that earns 7% interest annually at age 25. By the time you’re 65, your account balance will be over $1 million, assuming you never increase your contributions. This is the power of compound interest at work.

The key to long-term investing and retirement planning is to start early and invest consistently.

Investment Accounts:

Investment accounts, such as brokerage accounts and retirement accounts, also offer the potential for compound interest. With these types of accounts, your money is invested in stocks, bonds, or other assets, and you earn returns based on the performance of those investments.

The power of compound interest can be seen when you reinvest your investment returns. For example, if you earn a 10% return on a $10,000 investment in the first year, you will have $11,000 at the end of the year. If you reinvest that $1,000 and earn another 10% return in the second year, you will have $12,100 at the end of the second year.

Over time, the compounding effect can lead to significant growth in your investment portfolio. This is why long-term investing is so important. The longer your money has to grow, the more powerful the compounding effect becomes.

Retirement Planning:

Compound interest is a critical concept when it comes to retirement planning. The earlier you start saving for retirement, the more time you have for compound interest to work its magic. For example, if you start saving $5,000 per year at age 25 and earn an average annual return of 8%, you will have nearly $1.2 million saved by age 65. If you wait until age 35 to start saving the same amount, you will have just over $500,000 saved by age 65.

Even small increases in your annual return or your savings rate can have a big impact on your retirement savings. For example, increasing your annual return from 8% to 9% can increase your savings by nearly $400,000 over a 40-year period.

It’s also important to understand the impact of fees on your investment returns. High fees can eat into your returns and significantly reduce the power of compound interest. Be sure to choose low-cost investments, such as index funds, and avoid high-fee financial products like actively managed mutual funds.

Compound interest is a powerful force that can help you grow your savings and build wealth over time. By understanding how it works and taking advantage of it through savings accounts and investment accounts, you can maximize your savings and achieve your financial goals.

Remember, the key to making compound interest work for you is time. The earlier you start saving and investing, the more time you have for your money to grow. Even small amounts of money saved and invested regularly can add up to big savings over time.

Take the time to explore your options for savings accounts and investment accounts, and consider working with a financial advisor to develop a long-term plan for your financial future. With the power of compound interest on your side, you can achieve your financial goals and enjoy a more secure future.